You Always Remember Your First

Jumping into the deep end: activist short selling and Chinese tech.

Dropped on your head at birth1? Devoid of normal trading fear? Dogged beyond normal healthy levels of due diligence? Hey, maybe you just want to make money in the hardest possible way in the stock market.

Great news: you can become an activist short seller.

Activist short selling involves publicly taking a stance—both philosophically and financially—against a company. The goal is either to hold the company accountable to drive change across its (alleged) errant ways or, frankly, to punch it out of the market for committing fraud (if they're committing fraud).

It's difficult, and it's unforgiving. No one likes you. In fact, everyone sort of hates you. In good faith, we have to say that you really shouldn't do it.

So, while I'm clearly not the best choice to write the membership recruitment brochure for Unnamed & Nondescript Short Selling Club™, I can accurately describe the members of this very small group of market participants.

It should come as no surprise to you, fair reader, that the opportunity to punch bad people in the face with a fistful of good information is just too tempting a treasure for yours truly to decline gracefully.

As I often did throughout 2018 and 2019, I connected and collaborated with people, using these connections for mutual growth and learning. Eventually, I made a friend who, you guessed it, happened to be a short seller who was also very interested in OSINT.

As you can imagine, we became fast friends. Two neurodivergent homies hyper-fixated on what the other one does.

One thing led to another, and finally, in 2019, my phone rang, and the person on the other line, after a brief introduction, gave me the name of a Chinese tech company, Qutoutiao, or $QTT. With the basics in hand, they asked me a question I would come to hear frequently throughout my short selling career…

“Ok, how the fuck do they make their money?”

This phrase is often uttered with various flavours of market and accounting jargon thrown in. And it's the most critical thing to get your head around as an analyst or investigator working with a short seller or doing due diligence with a financial lens.

How the fuck do they make their money?

Sounds easy, doesn't it? Maybe they sell widgets? Or phones?

Hey! Maybe they sell cars. So they make their money selling cars! Right? ... I said, "Right?"2

Wrong. To answer that question, you're looking at months of research to understand every little thing—from how those cars move in, move out, are bought, sold, listed, how they're transported and how the consumer or customer of that product react to using that product.

Even then, you might not be able to figure out how they’re making the money they say they're making.

It's a whole thing, you know, due diligence. Most people don't do it. They might say they do, or they might think they do, but those who do, they don't do it right or thoroughly enough to pass muster for a short seller.

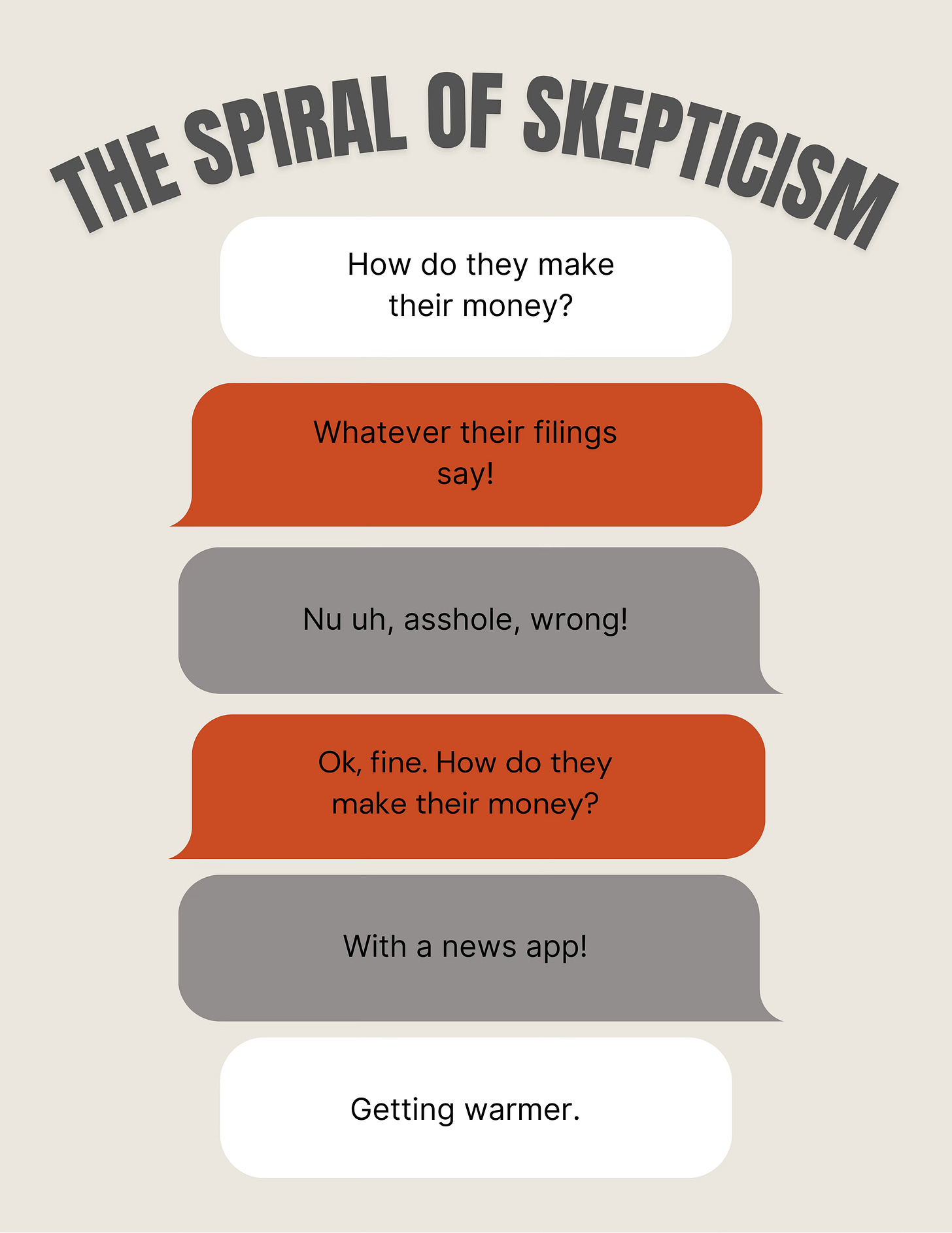

You need to work in this endless, downward Spiral of Skepticism:

“I have no clue who this company is, but let me see what’s up, and I’ll get back to you,” I responded excitedly.

Fuck yes! My first chance to dig into one of these shady Chinese companies that I’d seen featured in countless articles and documentaries and had read numerous short selling reports, detailing everything from fake factories to vanishing executives.

Put me in, coach. I’m ready to play.

Start With the Basics

Whether it’s short selling, wrongful convictions or chasing Russian hackers, I start each case the same way, with a timeline and a lot of reading.

Time-lining a company, its filings, recent news articles and building background before you start doing any technical analysis or data gathering is incredibly helpful, allowing you to mentally and technically tie the data to the business itself.

What point is there in beginning to analyze network traffic or technical indicators if you don’t understand what the data does for the company or how it impacts its profitability?

Too often, investigators will sink their sharpened teeth into a case like a wild dog. Running on instinct without slowing down, thinking, questioning, strategizing, and building a meticulous timeline of events. You should only be moving on from these basics to the sexier analytical work when it’s appropriate.

Like in relationships, sexy is built on top of the little things. *makes eyes at you*

This part is often where hired-gun technical analysts or consulting firms (read: web scrapers) get a bit lost in the mix. You have to be gathering data and information to answer a very specific question. If you're spending a bunch of time gathering data that is irrelevant or doesn't help you close the loop on a company's filings? You're doing it wrong.

Now, back to QTT.

So, after reading some background on QTT, I quickly became confused. It wasn't how they made their money; rather, it was how they made so much of it. The entire company was underpinned by one of the worst news reading applications I had ever seen, including some bizarre incentivization rewards for reading some of the shittiest, bottom-of-the-page junk articles I had ever seen.

At the time, their market capitalization, a measure of how much of their shitty stock investors have acquired, was north of a billion dollars, and they had revenue numbers in the $500-800m per year range.

How the fuck is this even possible, I wondered.

Is it something simple, like the extremely large market in China that could explain it? I was scratching my head at this point.

Then, we had their CEO buying real estate3 that would make Tony Montana blush.

Sweet jumping German Jesus riding a rainbow sleigh, that’s a lot of cake.

Two thumbs up indeed, Eric!

What am I missing here? Is the bull case for this company correct in that they are somehow turning ravenous, shit-news-reading Chinese folks into hundreds of millions of dollars a year in real scrillah?

Only one way to find out how an app company makes their money. You have to analyze the app itself and the data that it transmits and receives.

Climbing into the Asshole of the App

The fun part about analyzing a technology company is that if you have a background in digital forensics, reverse engineering, data science, journalism, or dog walking, it all becomes relevant and useful at some point, on some project.

In this case, for example, exploring the app as a forensic examiner yields some funny hits:

While this may look like gibberish to a non-technical person, anytime I see: "cocklogic," you know I’m Googling it. The libNativeExample.so file is also, as a Bullshit Hunter, a standout item.

Why would a $1B company have a library of code with the word "Example" in it? That's like having "demo" in the name or "dont-ship-this-code" or something.

It seems a bit sloppy, doesn't it?

Well, turns out, it's because that particular library is the end result if you follow an online Android coding tutorial, which the QTT developers obviously did without even changing the name before doing so.

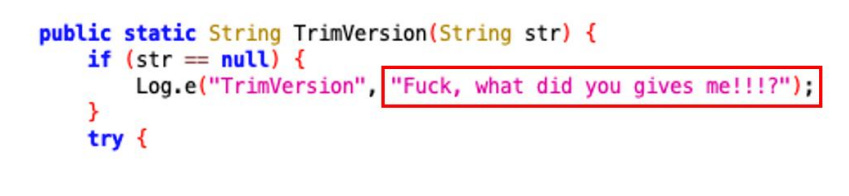

Now, switching into our "hacker robe," we can decompile the Android code to try to understand how the application does what it does. Even if you don't understand the code, you can see some fun things:

Tsk, tsk, developers! Such foul language for my poor virginal eyes, how will I ever recover?

These little snippets alone are no smoking gun. They're not really anything new that our eyes (or YouTube user @AustinInChina) couldn't have told us first: this is a shitty application, coded by people who were likely winging it.

What this all means so far is that the company has a lot of technical risks (a shitty, wobbly, popsicle-stick-and-twine app), the CEO has a bigass mansion, and their technical capabilities are, let's say… rather under-developed.

These are all qualitative signals but are good signs so far that there might still be something stinky to discover. What we now need to do is quantify the shittiness.

This can be the hardest and most time-consuming part of a due diligence or short selling project, which is why we will cover it in Part 2 of this series. I'll also show you how short sellers close the loop on their due diligence and investigative work.

It's impressive.

Half-Conclusion

While you wait for Part 2, it’s worth remembering that when you start every investigation, regardless of the subject matter, client or purpose, with very simple, meticulous time-lining, it can go a long way in providing valuable context before diving into more technical analysis tasks.

To this day, I encounter seasoned investigators who skip this step and are often surprised at the results I turn up by looking at the exact same data they did, just in a timeline.

Till next time, practice your timelining. I will be too.

“The Darth Vader of Wall Street” - on Jim Chanos, legendary short seller. https://cred.club/articles/the-darth-vader-of-wall-street

We did write about the catastrophic online car dealer, Vroom:

https://www.bullshithunting.com/p/tales-from-the-filings-dude-wheres

Variety. October 30, 2019.

https://www.yahoo.com/entertainment/chinese-tech-billionaire-buys-37-122910163.html